Yo, Credit Card Rates Are a Freakin’ Nightmare

Credit card rates are straight-up robbing me blind, and I’m betting you’re feeling the same sting. I’m sitting here in my tiny apartment in Chicago, the radiator clanking like it’s auditioning for a horror movie, staring at a credit card statement that’s got an APR so high it might as well be a phone number. Like, 24.99%? Seriously? I spilled my coffee on the bill when I saw that number—left a nice brown ring right over the balance. Anyway, I’m gonna break down why these rates are so high, share some dumb mistakes I’ve made, and maybe help you dodge the same traps. Buckle up, ‘cause my financial life’s a hot mess, and I’m not holding back.

Why Are Credit Card Rates So Damn High?

Okay, so why do credit card rates feel like they’re personally attacking us? From what I’ve learned (mostly the hard way), it’s a mix of stuff like the economy, your credit score, and the card companies just being greedy. The Federal Reserve’s been hiking interest rates lately—check out this article from Forbes for the nerdy details—and that jacks up the baseline for variable APRs. My card’s variable APR shot up from 19% to 24% in, like, six months, and I didn’t even notice ‘til I was drowning in interest.

Here’s the kicker: your credit score’s a huge player. Mine’s… let’s just say it’s taken some hits. I missed a payment back in 2023—okay, fine, two payments—’cause I was juggling moving costs and a car repair. Big mistake. My rate skyrocketed to a “penalty APR” of 29.99%. Ouch. According to Experian, lower scores mean higher rates, ‘cause banks think you’re a riskier bet. Fair, I guess, but it still stings.

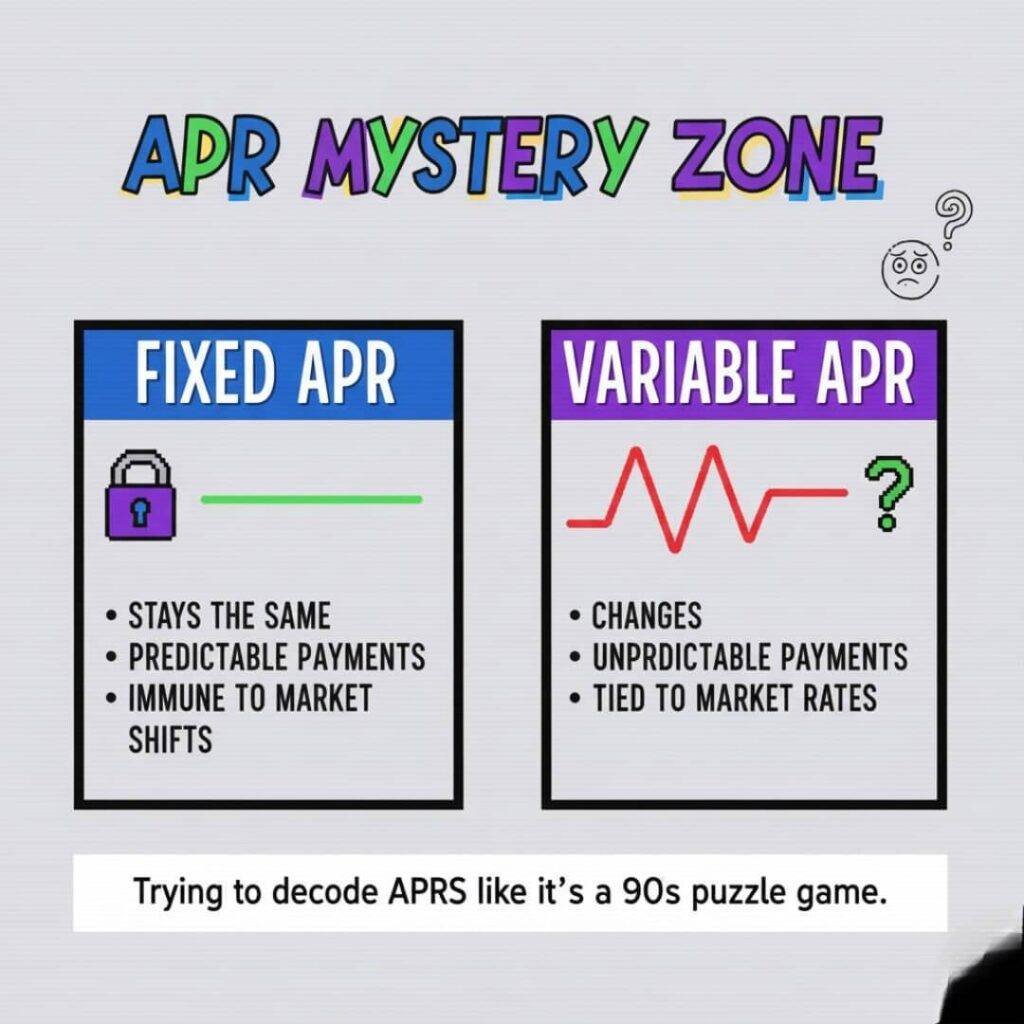

Fixed vs. Variable APR: What’s the Deal?

Alright, let’s talk fixed vs. variable APR, ‘cause I totally screwed this up. Fixed APRs stay the same, which sounds chill, right? But banks can still change them with, like, 45 days’ notice—learned that from Bankrate. Variable APRs, though, they’re tied to the prime rate, which moves with the economy. My card’s variable, and when the Fed bumped rates, my interest did too. I was at a diner in Wicker Park last week, scarfing down a greasy burger, when I checked my banking app and saw my APR had crept up again. Nearly choked on a fry.

Here’s what I wish I knew:

- Fixed APR: Good if you want predictability, but read the fine print—they’re not that fixed.

- Variable APR: Riskier when rates are climbing (like now), but sometimes lower to start.

- Pro tip: Call your card issuer and ask for a lower rate. I did this last month, totally nervous, and they dropped mine by 2%. Felt like I won the lottery.

My Biggest Credit Card Rate Screw-Ups

I’m gonna get real here: I’ve made some dumb moves with credit card rates. Like, embarrassingly dumb. Back in 2024, I signed up for a shiny new card ‘cause it had a 0% intro APR. Sounded sweet, right? Didn’t read the fine print. That intro rate expired after 12 months, and I got slapped with a 26% APR. I was in a Target in Evanston, buying way too many candles, when I realized I was paying interest on stuff I bought months ago. My bad.

Another time, I ignored those “balance transfer” offers in the mail. Thought they were junk. Turns out, they could’ve saved me hundreds by moving my high-rate balance to a lower-rate card. NerdWallet has a whole guide on this—wish I’d read it sooner. Moral of the story? Don’t be me. Read the terms, check your statements, and don’t buy six candles just ‘cause they smell like “autumn glow.”

How to Fight Back Against High Credit Card Rates

So, how do you deal with these soul-crushing credit card rates? I’m no expert, but here’s what’s worked for me (and what I’m still trying):

- Call and negotiate: I mentioned this already, but seriously, call your issuer. I was shaking when I did it—spilled my water all over my couch—but it worked.

- Balance transfers: Move your debt to a card with a lower or 0% intro APR. Just watch out for transfer fees—usually 3-5%.

- Pay more than the minimum: I used to pay just the minimum, thinking I was fine. Nope. Interest piles up fast. Now I throw every extra buck at my balance.

- Check your credit score: Use free tools like Credit Karma to track it. Better score, better rates.

Oh, and one more thing: I cut up one of my high-rate cards last week. Stood in my kitchen, scissors in hand, and just went for it. Felt like a badass, even if my floor’s now littered with plastic bits.

Wrapping Up This Credit Card Rate Rant

Look, credit card rates are a total scam sometimes, but you can fight back. I’m still figuring it out, messing up, and learning as I go. My apartment smells like burnt toast right now ‘cause I got distracted writing this, but whatever—I’m trying to get my financial life together. Check your rates, call your bank, and maybe don’t buy candles you don’t need. Got any tips or horror stories? Drop ‘em in the comments—I could use the help.