painting with a grainy edge, showing a crumpled dollar bill floating above a laptop with a flickering bond ETF chart. A glitchy stock ticker looms faintly behind, and a random paperclip is tangled in the scene, like I dropped it while stressing out. The tone’s cautiously optimistic but jittery, with olive greens, burnished golds, and neon blue clashes. Caption: “My bond ETF obsession, paperclip and all.”

Okay, So What’s the Deal with Bond ETFs?

Bond ETFs, man, they’ve been haunting my brain lately. I’m sitting here in my tiny Queens apartment, surrounded by takeout containers and my laptop screen glaring at me with numbers I barely get. I’m no finance bro—hell, I barely passed high school math—but I’m trying to figure out if bond ETFs are really safer than stocks. Like, I got burned bad last year when my stock picks tanked harder than my attempt to “taste the rainbow” with bodega sushi. Bond ETFs sound like they could be my financial security blanket, but are they? Let’s dig in, and I’ll spill the tea on my fumbles along the way.

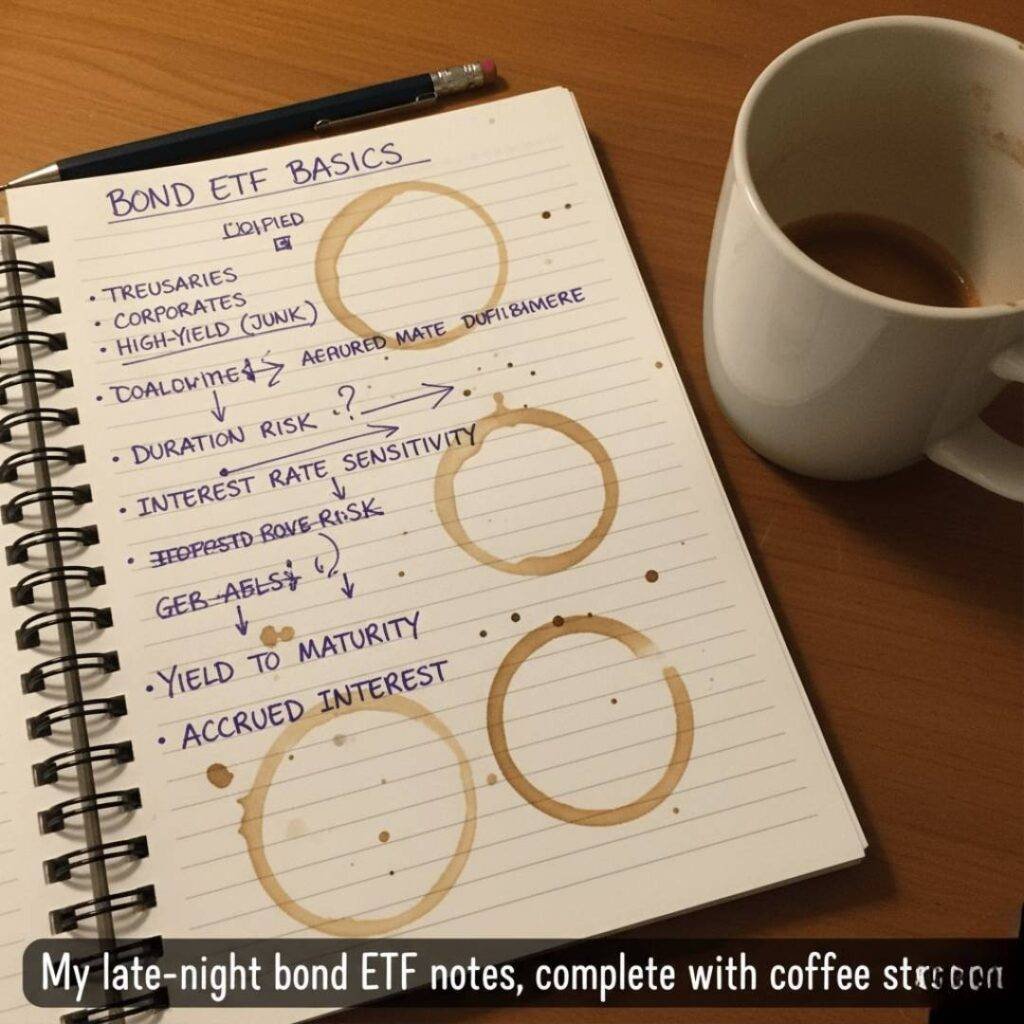

So, bond ETFs are basically these funds that bundle up a bunch of bonds—think government bonds, corporate ones, maybe some municipal stuff—and you can trade ‘em like stocks. I found this out while doomscrolling Investopedia at 3 a.m. (check it out: Investopedia on Bond ETFs), my eyes burning from too much screen time and cheap coffee. They’re supposed to be less of a wild ride than stocks, but I’m starting to think it’s not that simple.

Bond ETFs: The Lowdown (Or What I Think I Get)

Here’s what I’ve pieced together about bond ETFs, and bear with me, ‘cause I’m still wrapping my head around it:

- They’re diverse: Bond ETFs spread your cash across a ton of bonds, so if one flops, you’re not totally hosed.

- Easy to trade: You can buy or sell ‘em anytime the market’s open, unlike actual bonds, which feel like trying to haggle at a flea market.

- Cheap-ish: Most bond ETFs have lower fees than those fancy mutual funds. I learned this after getting rekt by a mutual fund’s fees a couple years back—yikes.

But, like, here’s where I screwed up. I thought all bond ETFs were safe, so I threw money into a high-yield one thinking I was gonna be rolling in it. Nope. It was almost as shaky as my crypto phase (don’t ask). Some bond ETFs track super-safe Treasury bonds, while others are into riskier stuff like corporate or junk bonds. Gotta read the fine print, folks.

Are Bond ETFs Actually Safer Than Stocks?

Alright, let’s cut to the chase: are safer than stocks? I’ve been through the stock market wringer—like that time I went all-in on a meme stock because Twitter hyped it up. Spoiler: I’m not retired on a yacht. Stocks are like that friend who’s a blast but might ditch you at a dive bar. ? They’re more like the friend who’s got your back with a granola bar when you’re hangry. Vanguard says are less volatile ‘cause bonds pay steady interest and you usually get your money back when they mature (if nothing goes bust) (Vanguard’s bond ETF guide).

But here’s where I’m torn. Bonds aren’t some magical shield. Interest rates go up, bond prices drop—boom, your ETF takes a hit. I felt this when I checked my bond ETF after a Fed rate hike and saw it dip. Not cool. Also, if you’re in a bond ETF with sketchy corporate bonds, you’re not exactly chilling in a bunker. It’s like thinking you’re safe in flip-flops during a blizzard—better than barefoot, but still sketchy.

Here’s my messy take:

- Pro can balance your portfolio when stocks are doing their yo-yo thing.

- Con: Interest rates or inflation spikes can mess you up.

- Huh? Moment: Some bond ETFs, like short-term Treasury ones, feel safe but pay so little I’m like , “Is this just a savings account with extra steps?”

My Epic Bond ETF Fail (and What It Taught Me

Real talk: I messed up big-time with last summer. I was at this rooftop party in Williamsburg, sipping a watery IPA, when my buddy Jake started yapping about this “killer” bond ETF. I got hyped, went home, and yeeted a chunk of my savings into it without even Googling. Turns out, it was loaded with long-term bonds, and when interest rates spiked, my account looked sadder than my fridge on a Sunday night. I was sitting there, AC blasting, sweat still dripping, cursing my impulsiveness.

What’d I learn? Do. Your. Research. Check what’s in the ETF—short-term or long-term bonds? Corporate or government? Duration’s a big deal (shorter’s usually safer). Sites like Morningstar (Morningstar’s ETF guide) are clutch for this. I now geek out over expense ratios and yield curves, which makes me sound like I know what I’m doing. I don’t.

Tips for Bond ETFs (From a Dude Who’s Still Figuring It Out)

If you’re thinking about bond ETFs, here’s my advice, straight from my dumpster fire of a learning curve:

- Don’t bet the farm: Start small, not like me throwing cash around after a few IPAs.

- Know your vibe: If market dips make you panic (hi, me), stick to Treasury or investment-grade bond ETFs.

- Stay woke on news: Interest rates and inflation are sneaky. Check Bloomberg for updates (Bloomberg’s bond market news).

- Mix it up: Bond ETFs are great for chilling out your portfolio, but don’t ghost stocks unless you’re super paranoid.

I’m still a hot mess with this stuff. Sometimes I think are my financial BFF; other times, I’m like, “Am I just kidding myself?” But they’ve definitely calmed my nerves compared to my all-stock daysBond ETFs , when I was checking my portfolio like it was a horror movie.

Wrapping Up This Bond ETF Rant

So, are safer than stocks? Kinda, but it’s not a fairy tale. They’re like the less chaotic cousin of stocks—still got issues, but maybe won’t make you cry as much. I’m still learning, still screwing up, and definitely still spilling coffee on my keyboard while researching. If you’re curious about ETFs, poke around, but don’t be like me at that rooftop party. Got your own investing horror stories or bond ETF thoughts? Hit me up on X or drop a comment—I’m all ears.